Health insurance quoting software has revolutionized the way insurance agents and brokers operate, streamlining the quoting process and enhancing customer satisfaction. This powerful tool automates the generation of personalized quotes, enabling agents to provide accurate and competitive options to their clients within minutes.

Table of Contents

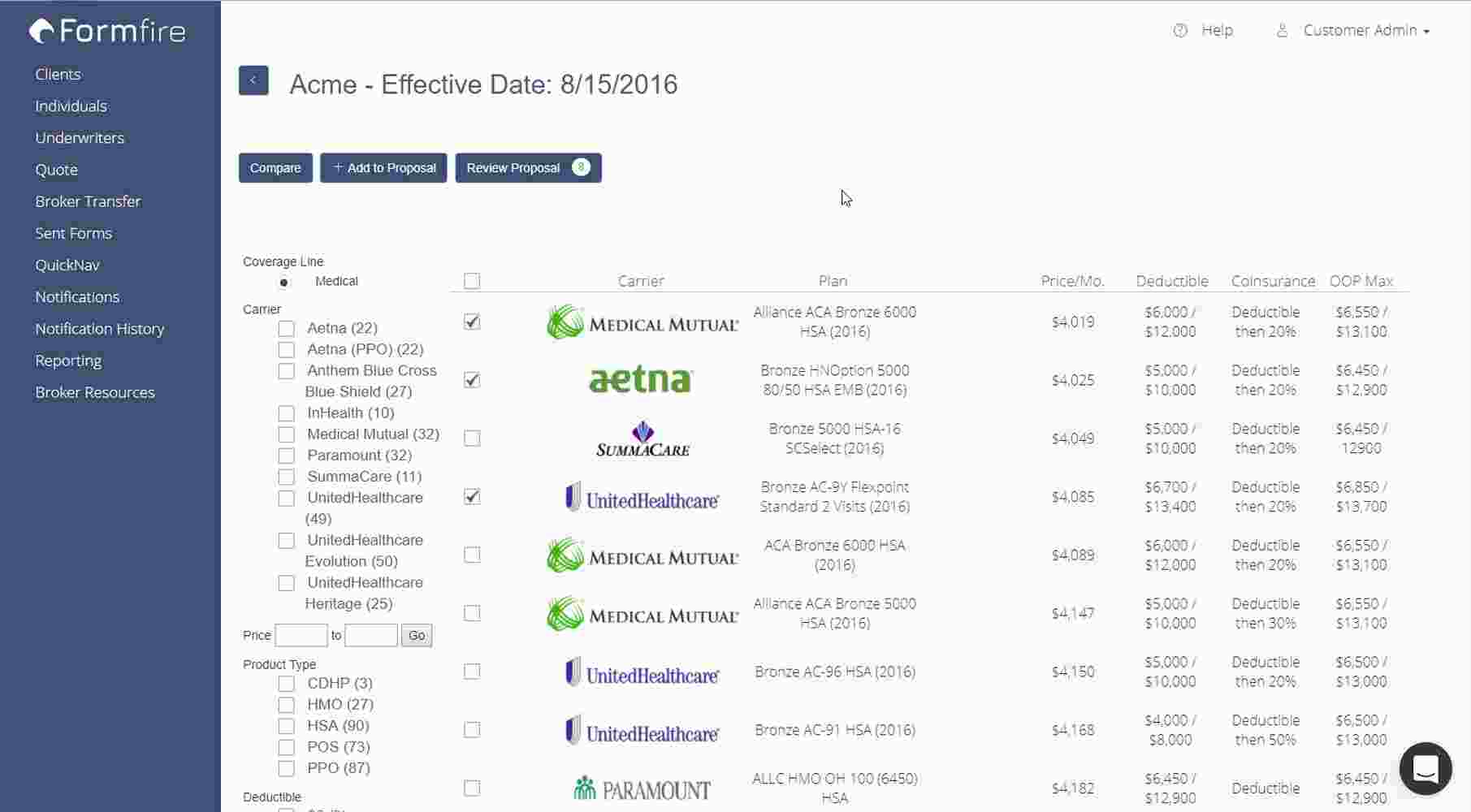

By integrating with various insurance carriers, health insurance quoting software offers real-time access to plan details and pricing, eliminating the need for manual data entry and reducing the risk of errors. Moreover, these platforms often incorporate data analysis capabilities, allowing agents to identify trends, optimize their strategies, and make informed decisions.

Benefits of Implementing Health Insurance Quoting Software

Implementing health insurance quoting software offers numerous advantages for insurance brokers and agencies, streamlining operations, improving customer experiences, and driving growth.

Enhanced Efficiency and Productivity

Health insurance quoting software significantly enhances efficiency and productivity by automating many manual tasks. The software can quickly generate accurate quotes based on client information and policy preferences, eliminating the need for time-consuming manual calculations. This automation frees up brokers and agents to focus on building relationships with clients, providing personalized advice, and closing deals.

Data Security and Compliance

Protecting sensitive client information is paramount in the health insurance industry. Health insurance quoting software handles a wealth of personal data, including names, addresses, social security numbers, medical history, and financial details. Data breaches can have severe consequences, including legal penalties, reputational damage, and financial losses. Therefore, robust data security measures and adherence to industry regulations are essential.

Compliance with Regulations

Health insurance quoting software must comply with various regulations to safeguard sensitive client information. Two prominent regulations are the Health Insurance Portability and Accountability Act (HIPAA) in the United States and the General Data Protection Regulation (GDPR) in the European Union.

HIPAA

HIPAA is a US federal law that sets standards for protecting sensitive patient health information (PHI). It applies to healthcare providers, health plans, and clearinghouses, including software vendors who handle PHI. HIPAA requires organizations to implement safeguards to protect PHI from unauthorized access, use, or disclosure.

GDPR

GDPR is a European Union law that aims to protect the personal data of individuals within the EU. It applies to organizations that process personal data of EU residents, regardless of the organization’s location. GDPR mandates stringent data protection measures, including obtaining consent for data processing, providing individuals with access to their data, and ensuring data security.

Data Security Measures, Health insurance quoting software

To ensure data security and compliance, health insurance quoting software should implement a comprehensive set of security measures.

| Security Measure | Description |

|---|---|

| Data Encryption | All sensitive data should be encrypted both in transit and at rest. Encryption uses algorithms to transform data into an unreadable format, making it inaccessible to unauthorized individuals. |

| Access Control | Implement access controls to restrict access to sensitive data based on user roles and permissions. This ensures that only authorized individuals can access specific data. |

| Regular Security Audits | Regularly audit security systems and practices to identify and address vulnerabilities. Audits help ensure that security measures remain effective and compliant with industry standards. |

| Employee Training | Provide employees with training on data security policies, best practices, and awareness of potential threats. Training helps employees understand their role in protecting sensitive data. |

| Incident Response Plan | Develop and implement a comprehensive incident response plan to handle data breaches or security incidents effectively. The plan should Artikel steps to contain the incident, mitigate damage, and notify affected individuals. |

Training and Support

Proper training and ongoing support are crucial for maximizing the value of health insurance quoting software. Users need to understand the software’s functionality, navigate its features effectively, and leverage its capabilities to streamline their operations.

Onboarding and Ongoing Support

Effective onboarding and ongoing support are essential for user adoption and satisfaction. This involves providing comprehensive training materials, resources, and ongoing assistance to ensure users can confidently use the software.

- Initial Training: A well-structured onboarding program should be provided to new users. This could include interactive tutorials, webinars, or in-person training sessions. The program should cover essential software features, workflows, and best practices.

- User Guides and Documentation: Comprehensive user guides and online documentation should be readily available. These resources should be detailed, easy to navigate, and updated regularly to reflect any software changes or updates.

- Knowledge Base and FAQs: A robust knowledge base and frequently asked questions (FAQs) section can help users find answers to common questions quickly. This can reduce the need for direct support and empower users to troubleshoot issues independently.

- Dedicated Support Team: A responsive support team should be available to address user queries, troubleshoot technical issues, and provide personalized assistance. This team should be knowledgeable about the software and capable of resolving issues promptly.

- Regular Updates and Enhancements: Ongoing support includes providing regular software updates, enhancements, and bug fixes. These updates should be communicated effectively to users, ensuring they have access to the latest features and improvements.

Training Materials and Resources

The types of training materials and resources provided should cater to different learning styles and user needs.

- Interactive Tutorials: Interactive tutorials provide a step-by-step guide through the software’s features and functionalities. They allow users to learn at their own pace and reinforce understanding through hands-on exercises.

- Video Demonstrations: Video demonstrations offer a visual explanation of software features and workflows. These videos can be particularly helpful for demonstrating complex functionalities or providing a quick overview of key processes.

- User Guides and Manuals: Comprehensive user guides and manuals provide detailed information about the software’s functionalities, settings, and troubleshooting tips. They should be well-organized and easy to navigate.

- Webinars and Online Courses: Webinars and online courses can offer in-depth training on specific software features or functionalities. They can also provide an opportunity for users to ask questions and interact with experts.

- Knowledge Base and FAQs: A comprehensive knowledge base and FAQs section should address common questions, troubleshooting steps, and best practices. This resource should be regularly updated to reflect any software changes or new features.

- Community Forums: Establishing a community forum allows users to connect with each other, share experiences, and learn from each other. This can foster a collaborative learning environment and provide a platform for addressing common issues.

Future Trends in Health Insurance Quoting Software

The health insurance quoting software market is constantly evolving, driven by technological advancements, changing consumer preferences, and the increasing complexity of the healthcare landscape. These trends are shaping the future of how health insurance quotes are generated and delivered, offering greater efficiency, personalization, and value for both insurers and consumers.

Advancements in Artificial Intelligence and Machine Learning

Artificial intelligence (AI) and machine learning (ML) are revolutionizing the health insurance quoting process. These technologies are enabling insurers to automate tasks, personalize quotes, and gain deeper insights into customer needs.

- Automated Underwriting: AI-powered underwriting systems can analyze vast amounts of data, including medical history, demographics, and lifestyle factors, to assess risk and generate accurate quotes in real-time. This streamlines the underwriting process, reducing manual effort and turnaround time. For example, companies like Lemonade and Metromile use AI to assess risk and provide instant quotes for insurance products, including health insurance.

- Personalized Quotes: AI algorithms can tailor quotes to individual customer profiles, taking into account their unique needs and preferences. By analyzing data from various sources, including social media and online activity, AI can create highly personalized quotes that are more likely to resonate with customers. For example, a health insurance company could use AI to offer a customized quote to a customer based on their health history, lifestyle choices, and even their social media activity, which could indicate their level of health consciousness.

- Fraud Detection: AI can help insurers detect fraudulent claims and applications by analyzing data patterns and identifying anomalies. This can reduce financial losses and ensure the integrity of the insurance system. For example, an insurance company could use AI to analyze claims data and identify patterns that suggest fraud, such as multiple claims for the same injury within a short period.

Closing Notes

In conclusion, health insurance quoting software has become an indispensable tool for insurance professionals seeking to enhance efficiency, improve customer service, and stay ahead in a competitive market. Its ability to automate tedious tasks, provide accurate quotes, and generate valuable insights empowers agents to focus on building relationships and meeting the unique needs of their clients. As technology continues to evolve, we can expect even more innovative features and functionalities to emerge, further transforming the landscape of health insurance quoting.

Health insurance quoting software can be a powerful tool for brokers and agents, streamlining the process of generating personalized quotes for clients. However, it’s crucial to ensure secure access to the software, especially when working remotely. A robust solution is to use a vnc server , allowing you to control your computer from anywhere, providing secure access to your quoting software and essential data.